Growing Your Business With Bookkeeping 2029373546

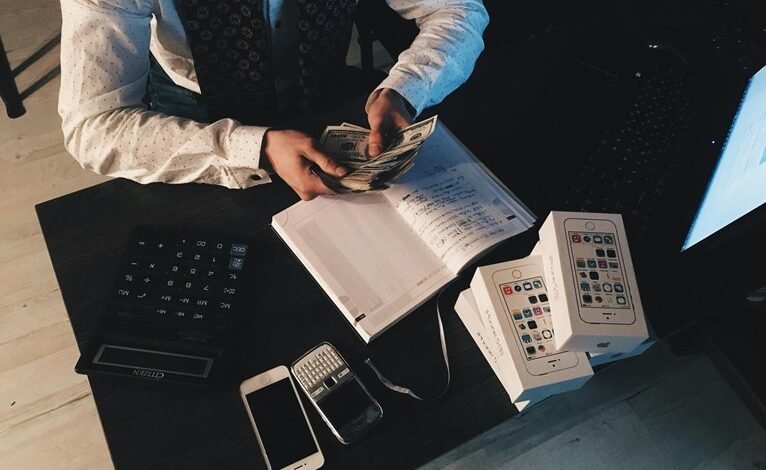

Effective bookkeeping serves as the backbone of any successful business strategy. It provides critical insights into financial health, facilitating informed decision-making and long-term planning. By understanding the nuances of cash flow and operational costs, businesses can identify areas for improvement and growth. As organizations increasingly rely on advanced financial tools, the potential for strategic growth becomes more pronounced. The next steps in this process may hold the key to unlocking sustainable success.

Understanding the Basics of Bookkeeping

A solid understanding of bookkeeping is essential for any business aiming to achieve financial stability and growth.

Effective record keeping forms the foundation of financial literacy, enabling entrepreneurs to monitor transactions, assess cash flow, and prepare for tax obligations.

The Impact of Bookkeeping on Business Decision-Making

Accurate bookkeeping significantly influences business decision-making processes.

By ensuring data accuracy, businesses can conduct effective financial analysis, leading to informed strategic choices.

Reliable financial records provide insights into cash flow, profitability, and operational efficiency, empowering entrepreneurs to identify growth opportunities and mitigate risks.

Ultimately, sound bookkeeping practices foster a culture of transparency and accountability, essential for achieving long-term business freedom and success.

Streamlining Your Financial Processes

Streamlining financial processes is essential for businesses aiming to enhance efficiency and reduce operational costs.

Implementing advanced financial software can significantly improve expense tracking, allowing for real-time insights into spending patterns. This facilitates informed decision-making and minimizes errors.

Leveraging Bookkeeping for Sustainable Growth

Effective financial processes lay the groundwork for leveraging bookkeeping as a strategic tool for sustainable growth.

By employing accurate financial forecasting and monitoring cash flow, businesses can identify trends and make informed decisions.

This proactive approach empowers organizations to allocate resources efficiently, mitigate risks, and capitalize on opportunities, ultimately fostering a more resilient and adaptable enterprise that aligns with their pursuit of freedom and growth.

Conclusion

In conclusion, effective bookkeeping is not merely a financial obligation; it is a strategic asset that drives business growth. By maintaining accurate records and utilizing advanced financial tools, businesses can enhance decision-making and uncover new opportunities. As organizations strive for sustainability and resilience, one must consider: how can precise financial management transform potential challenges into avenues for success? Embracing robust bookkeeping practices is essential for navigating today’s complex business landscape.