Building a Financial Future With Bookkeeping 6265697239

Accurate bookkeeping is a critical component in shaping a secure financial future. It provides individuals and small businesses with essential insights into their financial health. By systematically tracking income and expenses, stakeholders can make informed decisions. Moreover, effective bookkeeping can enhance compliance and mitigate tax challenges. However, the implications of well-maintained financial records extend beyond mere tracking. Understanding these dynamics can significantly impact long-term financial stability and growth.

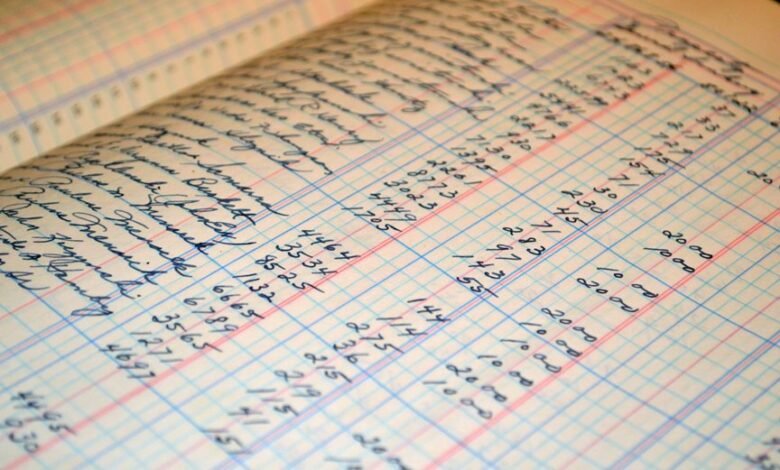

The Importance of Accurate Bookkeeping

Although many business owners may underestimate its significance, accurate bookkeeping serves as the backbone of financial management.

It ensures financial accuracy, enabling informed decision-making and strategic planning. The bookkeeping benefits extend beyond mere compliance; they foster transparency and accountability, essential for sustainable growth.

Ultimately, robust bookkeeping practices empower entrepreneurs to navigate their financial landscape with confidence and clarity, enhancing their freedom to innovate and expand.

How Bookkeeping 6265697239 Supports Small Businesses

When small businesses implement effective bookkeeping practices, they lay a solid foundation for financial stability and growth.

Bookkeeping 6265697239 enhances cash flow management through precise expense tracking, allowing business owners to identify spending patterns and optimize resources.

This clarity empowers entrepreneurs to make informed decisions, ultimately fostering a sustainable environment for innovation and expansion, which is essential for long-term success in a competitive market.

Personal Finance Management Through Effective Bookkeeping

Effective bookkeeping serves as a cornerstone for personal finance management, enabling individuals to gain a comprehensive understanding of their financial situation.

Through diligent budget tracking, individuals can monitor income and expenses, ensuring they remain within their financial limits.

Additionally, expense categorization allows for insightful analysis of spending patterns, empowering individuals to make informed decisions and ultimately achieve greater financial freedom.

Ensuring Compliance and Reducing Tax Liabilities

Ensuring compliance with tax regulations is essential for individuals and businesses alike, as failure to meet these requirements can result in significant financial penalties and legal complications.

Adhering to these regulations not only mitigates the risk of financial audits but also provides opportunities to reduce tax liabilities through strategic planning.

A thorough understanding of tax obligations empowers individuals to achieve financial freedom while maintaining compliance.

Conclusion

In the realm of financial management, accurate bookkeeping stands as both a shield and a sword; it protects individuals and small businesses from the chaos of disorganization while empowering them to seize growth opportunities. While the meticulous tracking of income and expenses may seem tedious, it ultimately transforms financial uncertainty into clarity and confidence. By prioritizing effective bookkeeping, one not only ensures compliance and reduces tax liabilities but also paves the way toward a prosperous and sustainable financial future.